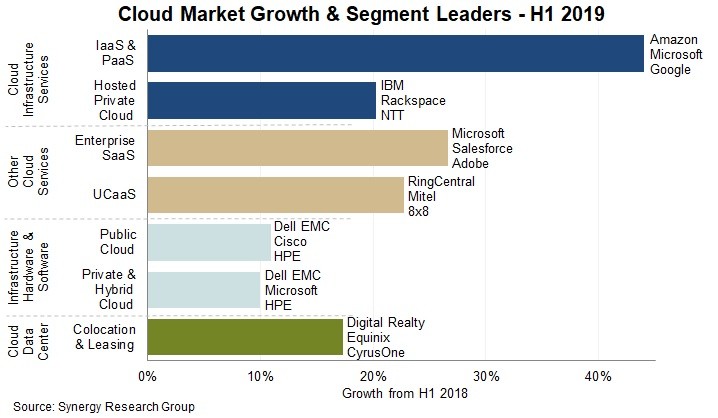

In the cloud service segments, IaaS & PaaS had the highest growth rate at 44%, followed by enterprise SaaS at 27%, UCaaS at 23% and hosted private cloud infrastructure services at 20%. Spending on hardware and software for public, private and hybrid infrastructure grew at just over 10%, while cloud provider spending on colocation and data center leasing grew by 17%. In aggregate, spending on cloud services is now far greater than spending on supporting data center infrastructure. Across the whole cloud ecosystem, companies that featured the most prominently among the first half market segment leaders were Microsoft, Amazon/AWS, Dell EMC, Cisco, HPE and Google. Other major players included Salesforce, Adobe, VMware, IBM, Digital Realty, Equinix and Rackspace. In aggregate these companies accounted for well over half of all cloud-related revenues.

In the first half of 2019, total spend on hardware and software used to build cloud infrastructure was almost $55 billion – somewhat evenly split between public and private clouds. Infrastructure investments by cloud service providers helped them to generate over $90 billion in revenues from cloud infrastructure services (IaaS, PaaS, hosted private cloud services) and enterprise SaaS, in addition to which their infrastructure supports internet services such as search, social networking, email, e-commerce, gaming and mobile apps. Those cloud providers need somewhere to house their infrastructure, so spending on data center leasing and colocation services continue to grow strongly. Meanwhile UCaaS, while in many ways a different type of market, is also growing strongly and is driving some radical changes in business communications.

“Cloud-associated markets are growing at rates ranging from 10% to well over 40% and annual spending on cloud will double in under four years. Cloud is increasingly dominating the IT landscape,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Cloud has opened up a range of opportunities for new market entrants and for disruptive technologies and business models. Amazon and Microsoft have led the charge in terms of driving changes and aggressively growing cloud revenue streams, but many other tech companies are also benefitting. The flip side is that some traditional IT players are having a hard time balancing protection of legacy businesses with the need to fully embrace cloud."