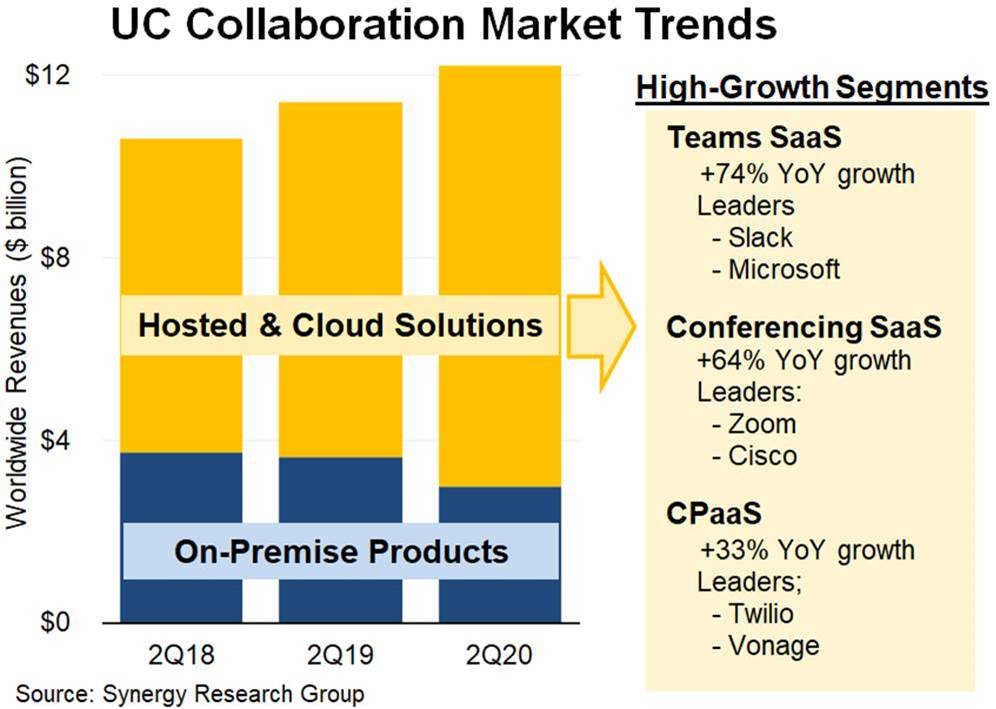

Most notably spending on hosted & cloud solutions grew by 18% while spending on on-premise products declined by 18%. Hosted and cloud now accounts for over three quarters of the market. While most hosted and cloud segments are expanding, growth was particularly strong in teams SaaS, conferencing SaaS and CPaaS. As a result Zoom, Twilio, Vonage and Slack all now feature strongly in the top ten ranking of collaboration vendors.

Within on-premise products the largest segments are IP telephony, video conferencing, on-premise email and content management. While total on-premise spending is in decline, there was at least some growth seen in video conferencing equipment. The highest growth segments in hosted & cloud solutions were teams, conferencing and CPaaS, but the largest segments remain hosted PBX & UCaaS, hosted contact center and hosted/cloud email.

“We were already seeing a steady migration in the collaboration market away from on-premise products and towards cloud solutions. COVID-19 and the sudden radical change in working practices has resulted in an acceleration of that transition,” said Jeremy Duke, Synergy Research Group’s founder and Chief Analyst. “CIOs need to find ways of maintaining communications and productivity in a world where remote working is the new norm and offices are sparsely populated. This is a world for which hosted and cloud solutions are perfectly suited.”